The Best Apps for Passive Income (Low Effort, Regular Returns)

Passive income apps like Fundrise, Crypto.com, Yieldstreet, SMBX, Worthy, and more can help you earn weekly, monthly or annual income on your investment.

ByBecca Stanek

Updated Feb 9, 2023

Many companies on MoneyMade advertise with us. Opinions are our own, but compensation and in-depth research determine where and how companies may appear.

Passive Income

Technology

Getting Started

Understandably, the possibility of bringing in money without a lot of active effort is appealing. When it comes to bringing in passive income, there are a number of different options, including an array of apps that allow you to invest in everything from alternatives to real estate to small businesses.

Whether you're investing to make money on the side or hoping to replace your income with investment returns one day, plenty of platforms for investing in real estate, small business loans, crypto, bonds, and more can help you get there. Read on for the rundown on some of the best apps for passive income so you can decide which one may be a fit for you.

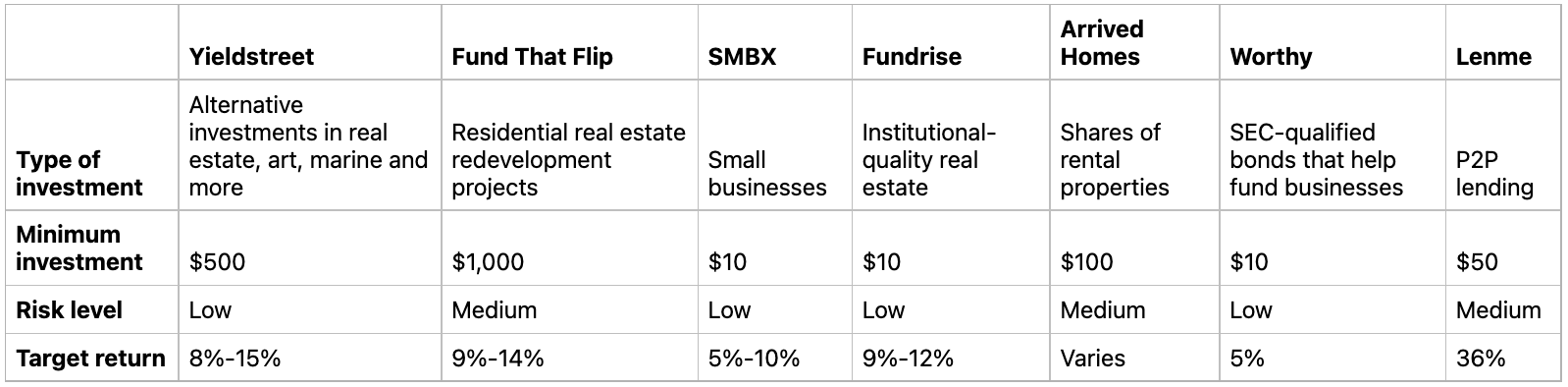

Comparing the best apps for passive income

Yieldstreet

- Get started with $500

- Must be an accredited investor for most opportunities

- Earn interest on a predefined or event-based schedule

Yieldstreet allows its users to invest in alternative investment opportunities generally reserved for institutional and ultra-wealthy investors. This includes investments in asset classes like art, real estate, marine finance and commercial and consumer finance. However, you must be an accredited investor to access these opportunities; non-accredited investors can only invest in the Yieldstreet Prism Fund.

Most of the platform's offerings have set payment schedules—such as monthly or quarterly—in which they pay out accrued interest, though some investments may distribute interest and principal based on an event, such as when individual cases within a portfolio settle. Target returns average around 8% to 15%, and there is the option to automatically reinvest interest earned in the Yieldstreet Prism Fund in lieu of receiving recurring payments.

Yieldstreet

4.4

•

Lending

Crypto.com

- Low $1 minimum investment, but high risk level

- Earn up to 14.5% interest on your crypto

- Receive deposits once every 7 days

Crypto.com allows you to bring in passive income by earning rewards on the crypto you own. You can earn up to 14.5% with some of the best crypto staking coins, though the exact amount you earn will depend on the term length you choose (flexible, 1 month or 3 months), the amount of your Crypto.com Coin stake ($400 or less, $4,000 or $40,000+) and what type of crypto you own (for instance, Dogecoin earns less than Polkadot).

Interest accrues daily, and you will receive your total accumulated interest every seven days deposited into your crypto wallet for immediate use, including for reinvestment. While you need only $1 to get started on the app, you will need to purchase crypto in order to earn interest, and the risk level is relatively high.

Fund That Flip

- Invest in increments of $5,000

- Must be an accredited investor

- Average anualized returns of over 10.75%

Fund That Flip offers yet another way to earn passive income by investing in residential real estate redevelopment projects online. The real estate projects are pre-vetted, and you can invest in $5,000 increments in order to help finance the purchase and rehabilitation of homes. Investors, who must be accredited, will effectively be investing in a Borrower Dependent Note (BDN), the performance of which correlates directly with the performance of a note that the company invests in with the project's redeveloper.

The platform's investors have earned an average annualized return of more than 10.75%, and see principal repayment in less than 10 months. Interest is paid out on a monthly basis, with investment terms ranging from six to 12 months. Keep in mind that BDNs are not liquid investments, and if you invest you should be prepared to hold your investment until maturity and, in some cases, even longer.

Upright

5.0

•

Real Estate

SMBX

- Open to all investors, with a minimum of just $10

- Invest in bonds to help fund small businesses

- Principal and interest are paid out monthly, so you can reinvest

SMBX is a platform that connects investors with small businesses that are looking for investors. With SMBX, investors will choose a business on the platform's marketplace to invest in by purchasing that business' bonds. From there, investors can expect to receive monthly payments for the duration of the bond. Since principal and interest are paid out on a monthly basis, users will have the opoortunity to reinvest their funds, or they can simply keep the funds in their account or withdraw them to their bank account.

Bond terms generally range from 36 to 60 months, and target returns range from 5% to 10%. While not as high as some other passive income opportunities listed here, the risk level is comparatively low and the platform is open to all investors—not just those who are accredited. You can start investing with as little as $10.

SMBX

5.0

•

Lending

Fundrise

- Get started with only $10 and no need to be an accredited investor

- Receive passive income through dividends

- Opportunity for income to increase if property value goes up

If you're hoping to earn passive income through institutional-quality real estate investing, Fundrise could be an app worth checking out. Fundrise offers investors the opportunity to earn steady monthly income from dividends, which you can choose to receive in cash or to reinvest. Additionally, you can potentially increase the dividends you earn if the value of the property in which you invested increases over time, leading to higher rent prices or a higher sales costs when the property is sold. Target returns are estimated to range from 9% to 12%.

The platform is available to all levels of investors, and you'll need just $10 to get started. While the level of risk is low compared to some other passive income apps, you will need to be prepared to invest for the long term—generally at least five years.

Fundrise

5.0

•

Real Estate

Arrived Homes

- Earn rental income without handling operational work

- Invest anywhere from $100 to $20,000 per house

- Medium risk level, with varied returns

With Arrived Homes, you can earn passive income through shares of rental properties you purchase. Plus, Arrived Homes handles the operational work—such as finding a renter and taking care of any maintenance—that usually accompanies a rental property.

Investors can expect to earn rental income and receive deposits on a quarterly basis, with the potential for their income to grow based on property appreciation. You can invest a minimum of $100 up to $20,000 per house, and you can spread your funds across several different properties. Each property has its own unique hold period, but investors can generally expect a timeline of five to seven years, after which the company will decide whether to sell the property.

Arrived

Real Estate

Worthy

- Support growing businesses through bond purchases

- Get a fixed interest rate of 5% on the money you invest

- Non-accredited investors limited on how many bonds they can buy

Worthy creates and sells SEC-qualified bonds, which investors can then buy to help fund loans for growing companies. As a bondholder, investors will earn 5% fixed interest on the money they invest, with interest compounding and paid out daily. This is a highly liquid investment as well since investors have the option to cash in their bonds at any time without incurring fees.

Investors can also easily reinvest their earnings by setting up auto purchases, which allow you to schedule future bond purchases.

The platform requires a low minimum investment of just $10. While any level of investor can buy them, non-accredited investors will be limited how many bonds they can buy. Whereas accredited investors can buy an unlimited number of bonds (with a $50,000 limit on online purchases), those who are not accredited can only buy up to 10% of their annual income or net worth.

Worthy

4.4

•

Lending

Lenme

- Lend money to borrowers and earn interest

- Target returns can range as high as 36%, with interest paid out monthly

- Short-duration investments, from 1-12 months

With Lenme, you can lend money to borrowers and earn passive income through the interest paid on the funds you've loaned. The peer-to-peer lending platform, which requires a minimum investment of $50, allows you to assess the risk and reward models of various investment opportunities so you can make a selection that aligns with your preferences. Interest is then paid out to investors on a monthly basis.

Unlike many of the investments offered by the top passive income apps on this list, Lenme offers short-duration investments, with terms ranging from one to 12 months. Target returns range as high as 36%, though you will pay a monthly subscription fee.

Lenme

Lending