Study: Could Sports Cards Be the Best Store of Value During Tough Economic Times?

This study shows that sports card prices remained stable through recent recessions and inflationary periods, making them an excellent store of value.

Updated Mar 23, 2023

Many companies on MoneyMade advertise with us. Opinions are our own, but compensation and in-depth research determine where and how companies may appear.

Sports Cards

Collectibles

Long Term Growth

Between falling markets and high inflation, investors are understandably worried about the rate at which their assets are losing value. Whether they leave their money in the stock market or put it in a bank account, it's likely to lose significant purchasing power this year. That's why investors are on the hunt for reliable "store of value" assets that can maintain their value during these challenging economic times.

While cash is the most common store of value, it doesn't retain its value well in high inflation environments. The US inflation rate hit a staggering 8.3% in April 2022. At that rate, it would take just nine years for your cash to lose half its value. In other words, if you have $10,000 sitting in a savings account now, and that rate were to remain constant, your money would be worth just $5,000 in 2029.

At the same time, the stock market has already fallen over 20% YTD. This, compounded by high inflation, means money invested in the market is losing value fast.

A good store of value should offer a stable, predictable value whenever you need to retrieve it, and sports cards have done a better job of that than bonds in recent years.

In addition to cash, investors often flock to bonds as a safe haven. However, recent data suggests that collectibles like art, wine, and sports cards might be a more lucrative option. Collectibles have long been used as an investment vehicle and a store of value by the upper class. More recently, these assets have become widely available to everyday investors—but most investors still don't know how they function in a portfolio.

This is largely because it hasn't always been easy to measure the performance of collectibles like sports cards against more mainstream investment vehicles like stocks and bonds due to a lack of centralized data. Thanks to data from PWCC, the world's largest trading card marketplace, it's now possible to examine exactly how sports cards perform as an investment vehicle.

PWCC has created various indices that track the performance of blue-chip sports cards over the last decade and a half. We used the PWCC 500 to dive into how sports cards held up as a store of value during both market crashes and high inflationary periods in recent years. Here's what we found.

PWCC

5.0

•

Sports Cards

Highlights

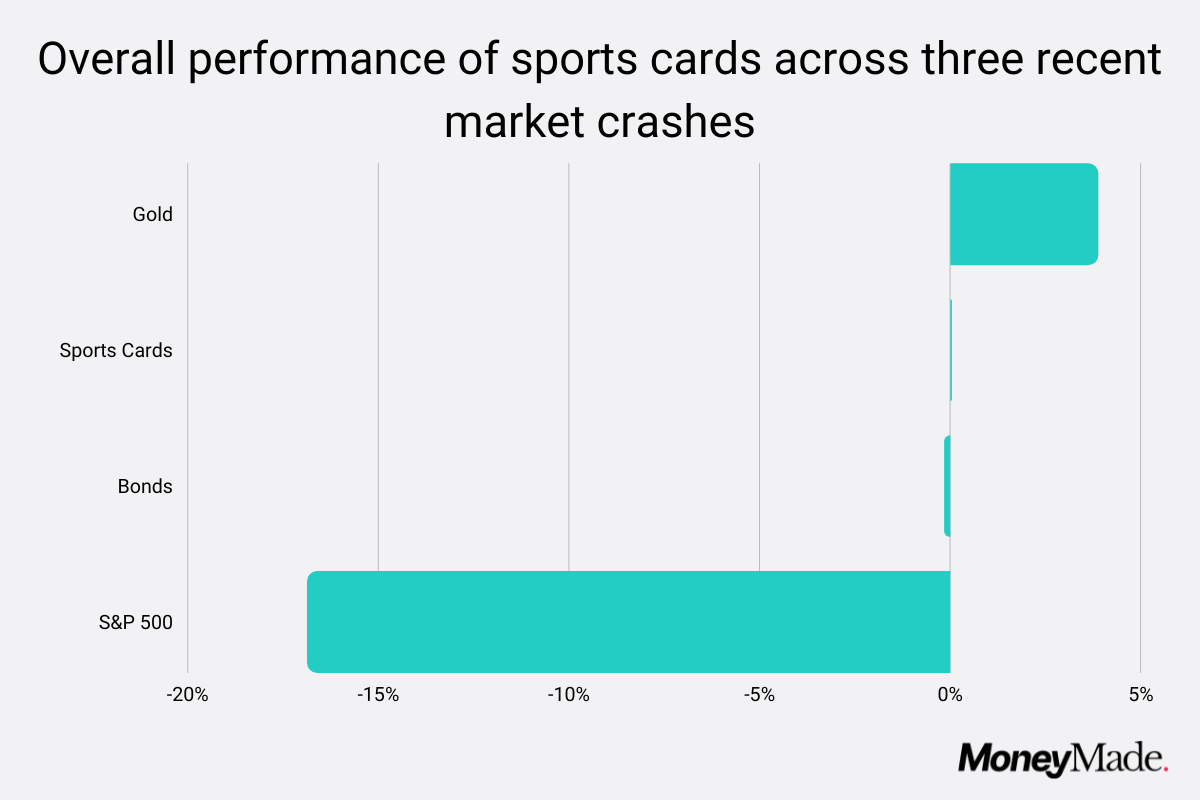

- Over the three most recent market crashes, sports cards have held a stable value. While the S&P 500 fell by an average of nearly 17% and bonds took a small hit, sports cards actually saw overall positive returns.

- During high inflation periods, sports cards have either held their value or offered an annual growth rate as high as 95%.

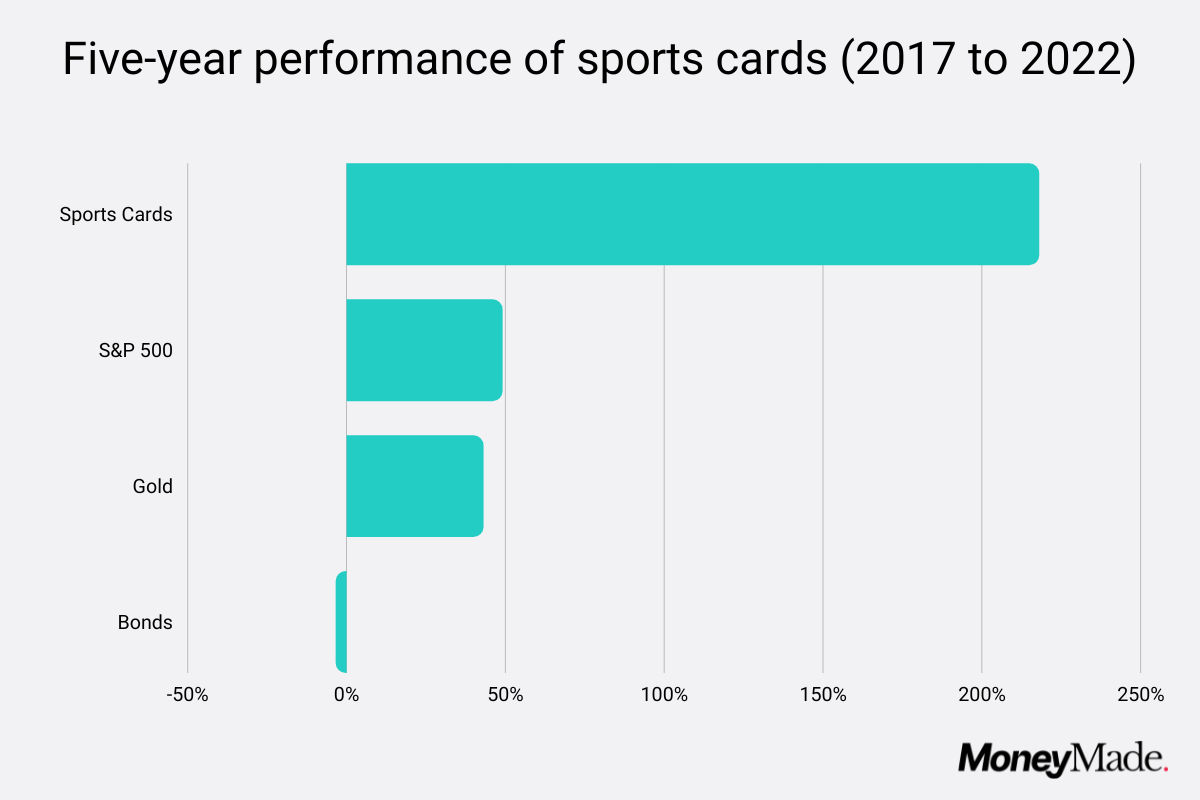

- Not only have sports cards offered stability in the midst of economic crises, but they've also proven lucrative when held over periods of one year or more. Over the last five years, sports cards have increased in value by 218%, outperforming nearly every other asset aside from cryptocurrency.

Performance of sports cards during stock market crashes

Preserving wealth is one of the biggest challenges investors face when the stock market takes a hit. It can be hard to find a good store of value during any recession, but it's particularly difficult during recessions that are paired with other economic difficulties.

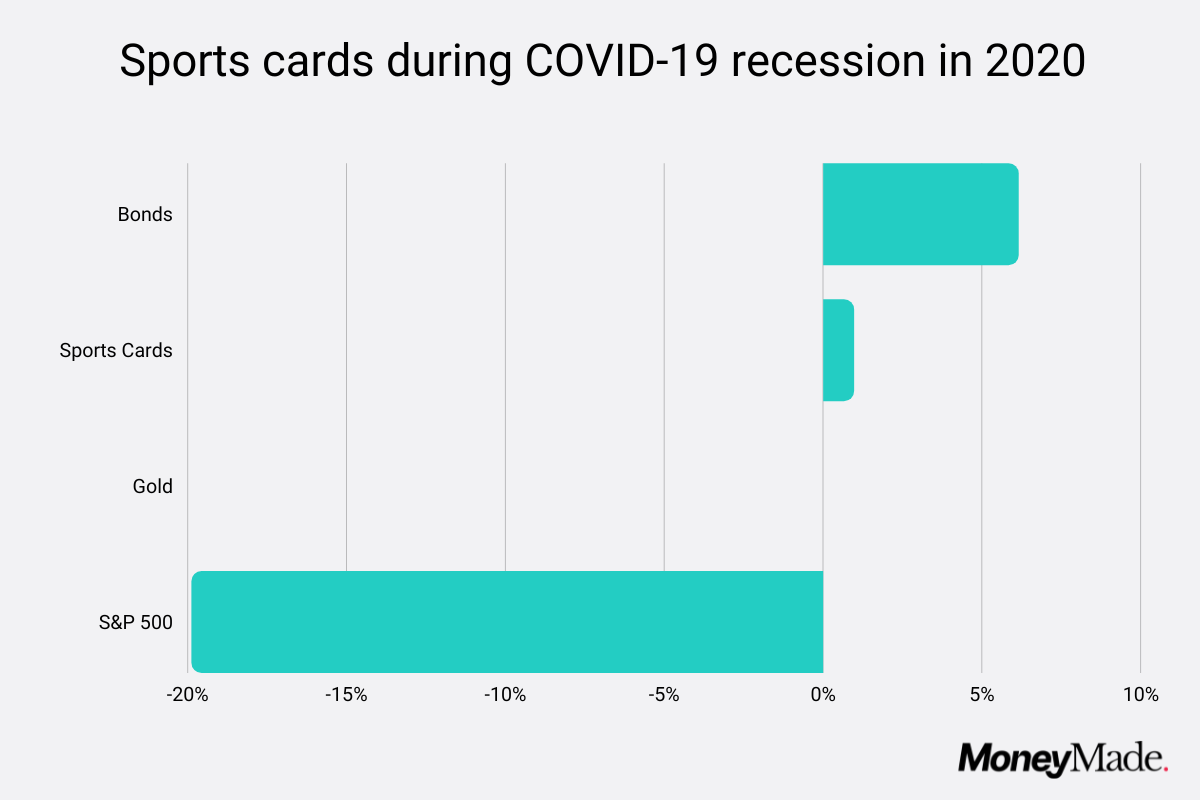

As we saw during the COVID-19 recession in 2020, the global pandemic took out most major industries, so even assets that typically perform well during a market downturn lost significant value. This has also been the case so far with the stock market crash in 2022, as dips in the market paired with high inflation have taken out almost every major asset class.

Sports cards, however, held their value incredibly well during both. In fact, in our study on the top-performing assets during three recent market crashes, sports cards came out as one of the best stores of value—even beating out typical investor safe havens like bonds and cash.

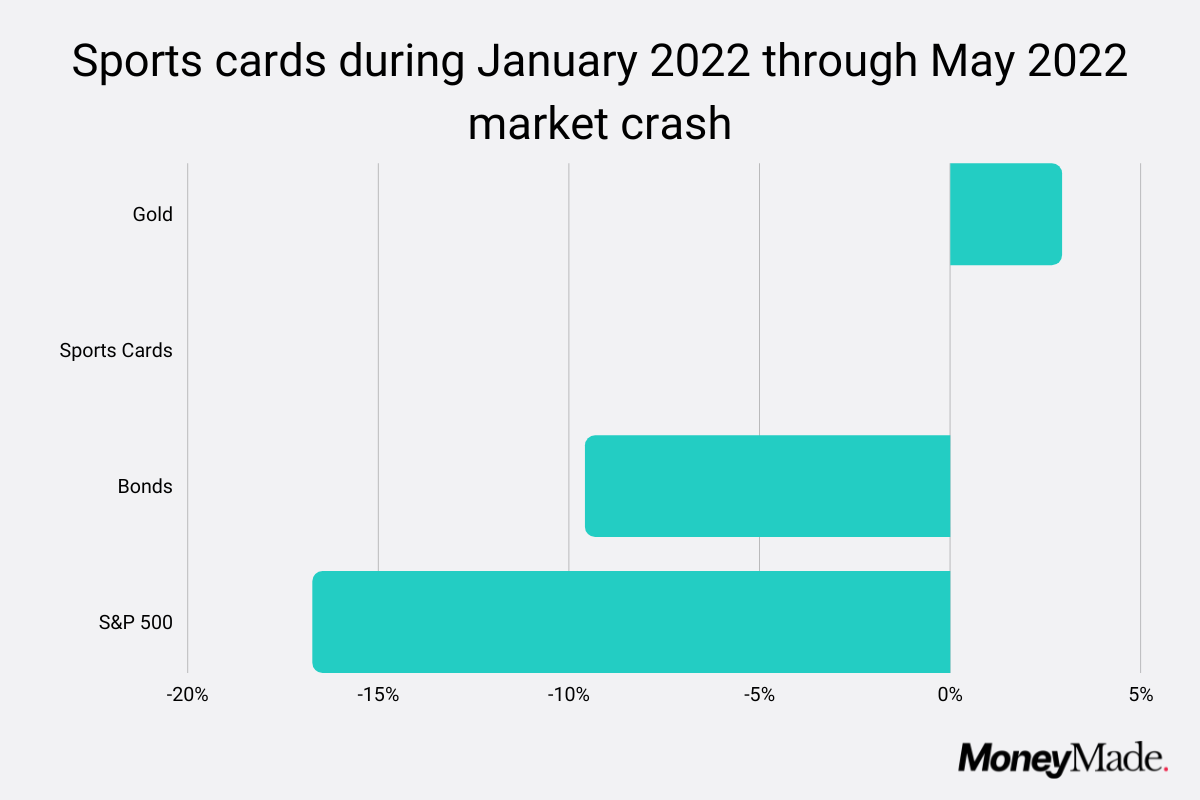

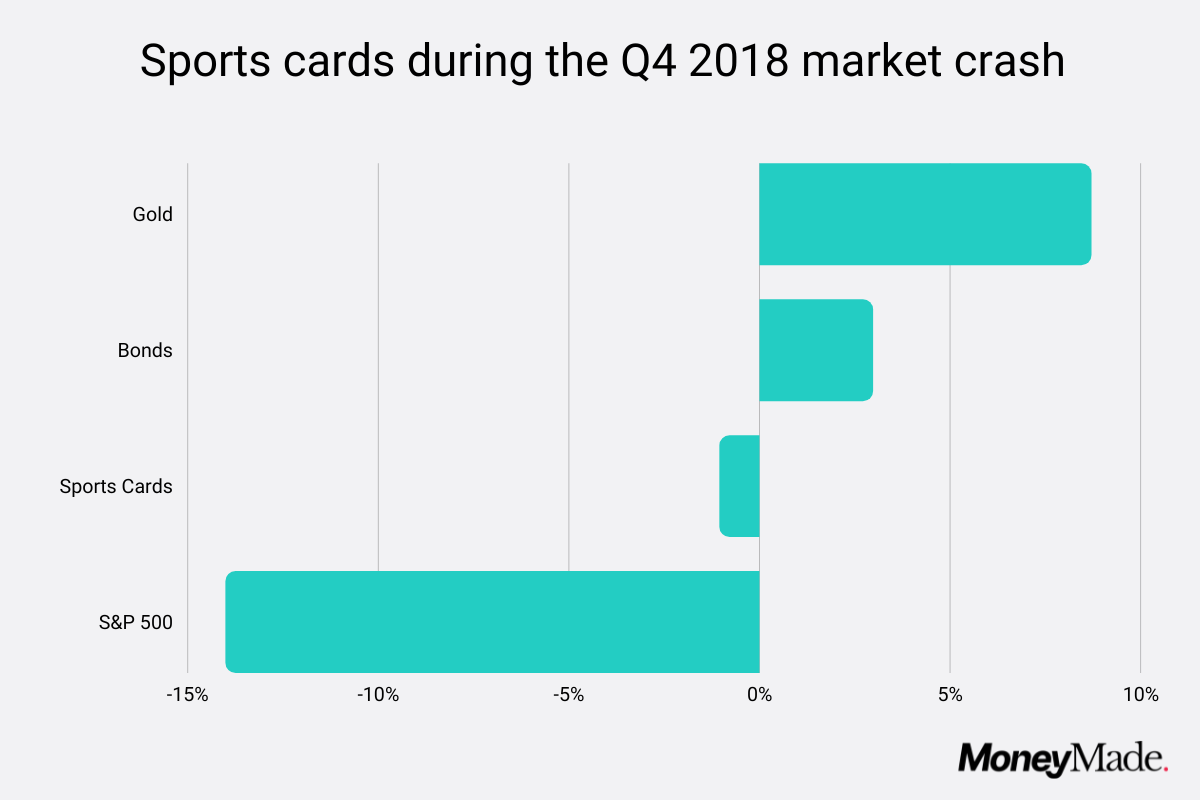

We looked at the stock market crash at the tail end of 2018, the COVID-19 recession, and the current market downturn (for the first half of 2022). When looking just at the period during which the S&P 500 was declining, sports cards maintained their value despite stock market declines as severe as 20%.

Overall, when averaged across all three recent market crashes, sports cards returned 0.03%. Bonds returned an average of -0.15%.

While this seems a small difference, it's worth noting that sports cards stayed stable across all three crashes, while bonds showed significant volatility, gaining just over 6% during the COVID-19 recession but losing nearly 10% during the first five months of 2022. A good store of value should offer a stable, predictable value whenever you need to retrieve it, and sports cards have done a better job of that than bonds in recent years.

Performance of sports cards over longer periods of time

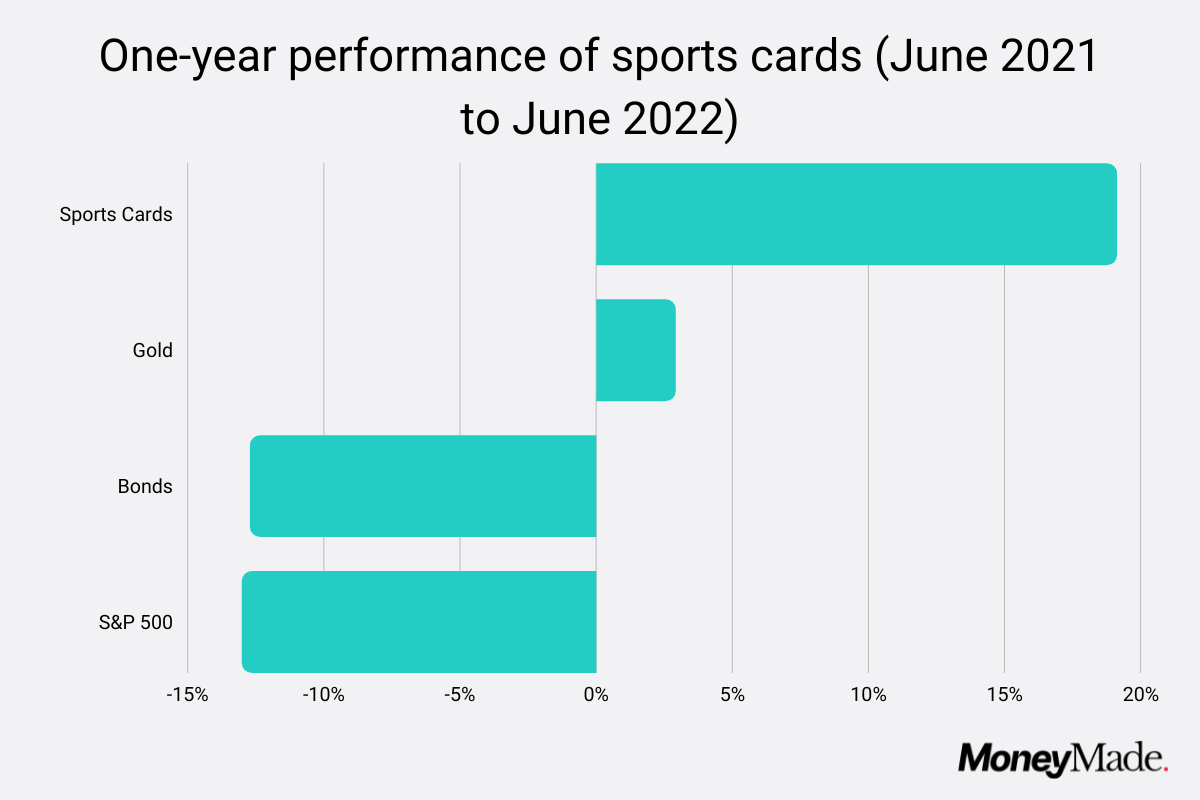

When you zoom out to view the performance of sports cards over a longer period of economic unrest, they look even more impressive.

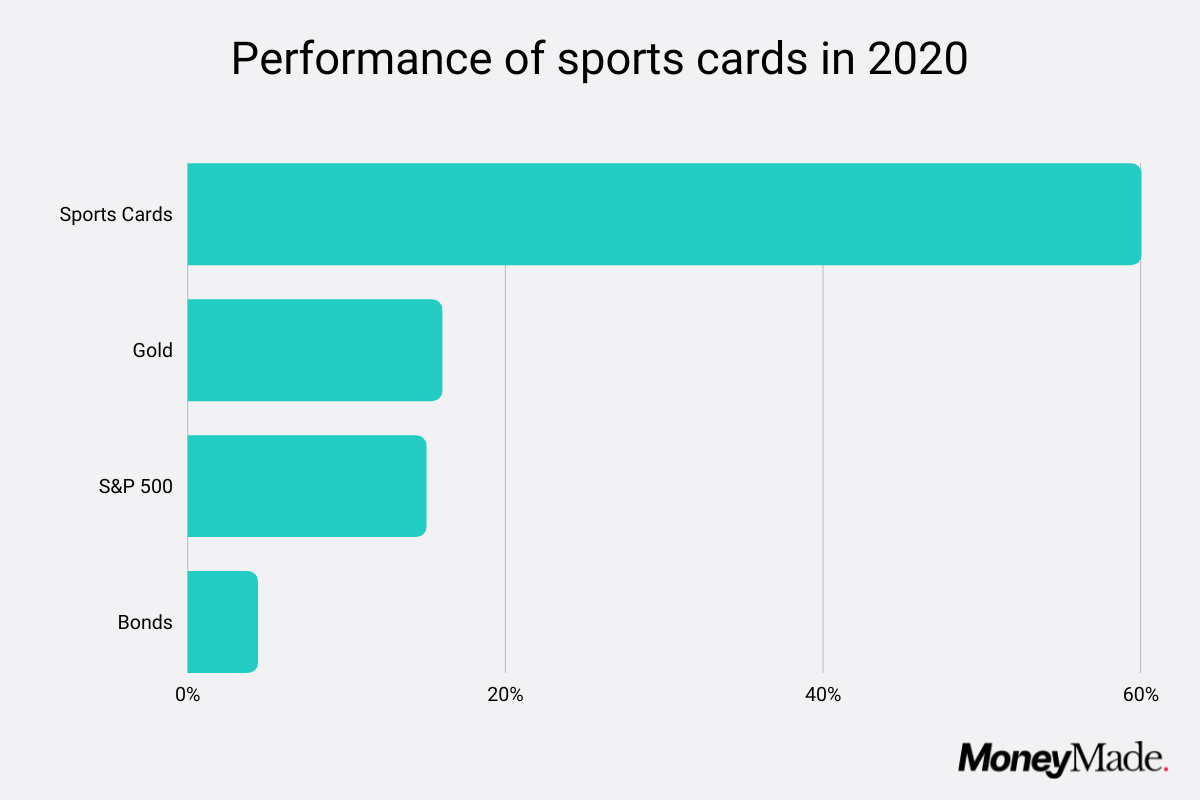

For example, while the stock market eventually recovered in 2020, the entire year was financially challenging for most Americans. The stock market saw overall gains of 15%, which was impressive. However, sports cards blew the S&P out of the water, returning 61% over the course of 2020. Gold, arguably one of the most popular stores of value, returned just over 16%, while bonds returned 4.4%.

In other words, not only do sports cards provide a stable store of value in the middle of a market crash, but they also have the potential to offer accelerated growth once the market begins to recover. Over longer periods of time, sports cards have offered generous returns in recent years, beating out other store of value assets as well as the S&P 500. Having produced a total return of 218% over the past five years, they've outperformed most other alternative asset classes—aside from cryptocurrency, which produces far more volatility than sports cards.

Sports cards during periods of inflation

Year | Inflation rate | Sports cards | S&P 500 | Bonds |

|---|---|---|---|---|

2008 | 3.8% | 1% | -37% | 18% |

2011 | 3.2% | 0% | 2.11% | 16% |

2021 | 4.7% | 95% | 22% | -5% |

2022 (Jan.-May) | 8.2% | 0% | -13.5% | -10% |

Average | 5% | 24% | -6.6% | 4.75% |

In high inflation environments, sports cards have tended to either hold their value or increase in value. They've outperformed cash during all four inflationary periods and bonds during the two most recent inflationary periods. Sports cards even outperformed the stock market during two of four inflationary periods since 2008.

It's worth noting that sports cards have become a much more accessible investment option in recent years, which may explain why they've done particularly well in 2021 and 2022.

When all four inflationary periods are averaged, sports cards significantly outperform both stocks and bonds. And while cash lost an average of 5% of its value across these inflationary periods, sports cards gained 24%.

This data suggests that sports cards could be an excellent inflation hedge. In late 2021, BLS announced that the US dollar was losing 1% of its value every 30 days. The inflation rate surpassed 8% by 2022, hitting 40-year record highs. This, paired with the S&P 500's nosedive, means even assets that can offer 0%—a stable price, in other words—are highly valuable right now.

As physical assets that hold emotional value, it makes sense that sports cards would be a good store of value during periods of economic uncertainty. While investors may sell off stocks and cryptocurrency at the first signs of market distress, they're unlikely to break into their sports card collection so quickly. Investors have an attachment to sports cards that goes beyond market performance, which may be at the heart of why they offer such impressive price stability.

Data gathered from PWCC

Sources

- NYSE. S&P 500 (SPX). Retrieved May 25, 2022 from MoneyMade.

- PWCC. PWCC 500. Retrieved May 25, 2022 from MoneyMade.

- NYSE. iShares Gold Trust (IAU). Retrieved May 25, 2022 from MoneyMade.

- NYSE. iShares 7-10 Year Treasury Bond ETF (IEF). Retrieved May 25, 2022 from MoneyMade.

- Binance. Bitcoin (BTC). Retrieved May 25, 2022 from MoneyMade.

- U.S. Bureau of Labor Statistics. (n.d.). Bureau of Labor Statistics Data. U.S. Bureau of Labor Statistics. Retrieved June 17, 2022, from data.bls.gov.